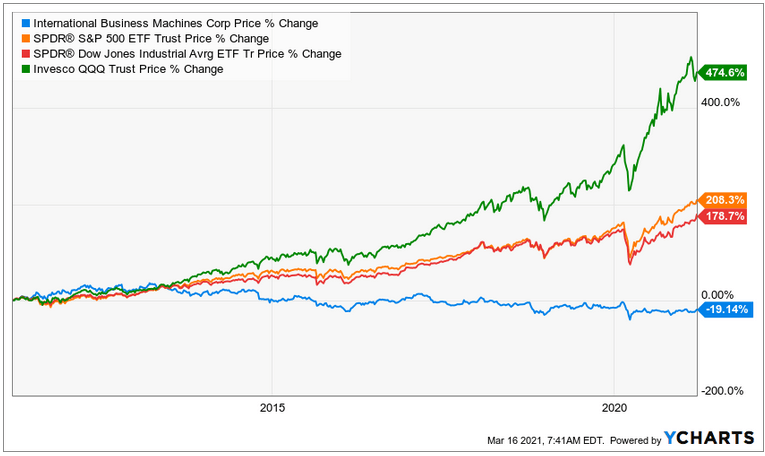

IBM is a multinational technology corporation with headquarters in Armonk, New York. It operates in more than 171 countries. Its share price has been increasing for the last several years. Its business is very profitable, and it has dividend payouts that keep shareholders happy. If you want to learn more about IBM, read on.

ibm’s dividend payout ratio

IBM’s dividend payout ratio is an important measure of the company’s ability to sustain dividend payments. A low payout ratio means that the company won’t need to issue debt to pay dividends. Larger companies tend to have a higher payout ratio than small companies. This indicates that IBM’s current financial condition is safe, but it should be noted that the company is still in a transition phase.

The dividend payout ratio of International Business Machines is an important factor in determining whether to invest in the stock. This number represents the percentage of net income distributed to shareholders as a dividend. The calculation is done by dividing the dividend per share by the net income per share. It’s important to keep in mind that the percentage is not a guarantee of future dividend payments, as accountants tend to manipulate the numbers by adjusting for non-cash items.

IBM has a long track record of raising its dividend and maintaining high payout ratios. It has also been expanding its cloud offerings through its acquisition of Red Hat, which should generate billions of dollars in sales over the next decade. This expansion is likely to help IBM’s profitability, which should translate to bigger dividend payouts.

IBM pays its dividends quarterly. These dividends are paid to registered stockholders. These dividends are usually determined by the Board of Directors. The Board of Directors also establishes the record date, which is the day on which a shareholder must hold his or her shares to receive the dividend. The dividend check must be received within three business days after the record date.

IBM’s dividend payout ratio is an important indicator of the company’s financial health. Its EPS is expected to grow by 32.6% in the next 12 months, but its dividend payout ratio is already higher than the company’s average quarterly income. A high payout ratio can put the company’s balance sheet under strain.

ibm’s business performance in Q3

IBM’s business performance in Q3 surpassed analyst expectations, and the company is on track to beat its own expectations. While the company has been battling a weak macroeconomic environment and softness in traditional businesses, the company is showing solid fundamentals in the areas of revenues and operating earnings per share. The company has also been able to drive material growth in cognitive, analytics and Quantum.

IBM’s cloud business has been a bright spot for the company, with cloud revenue up 6% over last year. The company has also benefited from the growth of its Red Hat acquisition and its hybrid cloud offerings. The cloud industry is increasingly moving to hybrid cloud, and IBM’s Cloud Paks are a key part of that growth.

Software revenues were up 7.5% year over year and beat analyst estimates. This includes proceeds from transaction processing software and consulting. Infrastructure revenues were down 3%, but the company’s cloud services continued to deliver impressive performance. It also boosted its partner relationships in AI, network automation, and security. This is likely to lead to more secure cloud services and improved performance.

Arvind Krishna, the CEO of IBM, has laid out a broad growth strategy. He’s focusing on artificial intelligence and cloud as two of the key growth areas for IBM. His strategy has allowed IBM to make steady investments in enterprise IT, even as consumer technology markets have weakened.

IBM’s third quarter 2022 results have surpassed expectations. Revenues in the third quarter of 2022 rose 6% year over year. Revenues for the quarter were $14.1 billion. While adjusted earnings decreased by a penny per share, the company’s free cash flow increased by $0.8 billion. IBM also paid $1.5 billion in dividends during the quarter.

ibm’s profitability

IBM’s profitability has plummeted since its problems began in 1995, when sales productivity flattened and profits declined. The company’s CEO, Virginia M. Rometty, inherited this fiasco from her predecessor, Paul Gerstner. The company paid $34 billion for Red Hat, and made sixty-three acquisitions in the first eighty-four months of her tenure. But it’s not all bad news. The bottom line is that the IBM management must put its business together and start firing on all cylinders.

The company’s profitability has dipped recently, primarily due to weak demand for its mainframes. The company has been facing significant competition from cloud-computing rivals and low-cost commodity server vendors. Still, IBM’s latest quarterly earnings report showed that it expects to stabilize its profitability next year.

Despite the continued financial headwinds, IBM has reported a positive earnings report for the second quarter of 2022. IBM reported revenue of $15.5 billion for the period ending June 30, up 9.26 percent from a year ago. Non-GAAP net income for the quarter was $2.1 billion, up 44.6 percent from the year-ago period. IBM’s cloud and infrastructure segment helped drive revenue growth.

IBM also reported its second-quarter earnings on July 18. While the company’s bottom line was above analyst estimates, its free cash flow was below expectations. The company ended the quarter with $1.9 billion in net cash from operating activities, down from $54.5 billion in the same period a year ago. Additionally, the company returned $1.5 billion in dividends.

Its dividend payouts

IBM’s dividend payouts are a great way for investors to get a steady stream of income from the company. Since 1916, IBM has consistently paid a quarterly dividend. Its current dividend yield is 4.60%. The company’s dividend is payable on September 10 to stockholders of record on that date.

However, IBM has been suffering from a combination of declining revenues and accelerating costs. This has further hurt per-share profit. Because of this, the company has cut its FYF forecast for this year to $10 billion, which should cover its expected dividend payout of $6 billion. In the past, IBM has had ample cash flow to cover its dividends, and this trend should continue.

IBM’s dividends are normally paid on 10th of March, the 10th of June, and on the 10th of September. The record date is usually one month before the dividend payment date. Therefore, it is advisable to purchase IBM stock before the ex-dividend date to ensure that you get your dividend.

You can choose to receive your dividends through direct deposit through your financial institution. Computershare will send the dividend to your designated bank account on the date it becomes payable. You can also reinvest your dividends with Computershare through the Computershare Investment Plan. This option requires you to be a stockholder of record.

Its business performance in Q3

IBM’s business performance in Q3 has been solid. While the company’s growth story has stalled, it’s still showing strong fundamentals. It’s making progress on its hybrid cloud story and continues to make material progress in analytics, Quantum and cognitive technologies.

Revenue from continuing operations was down in the third quarter, but the company beat Wall Street’s consensus estimate. While revenue rose 5.4%, sales fell 14.8% in its systems segment. Currency translation hit the third quarter’s top-line by $1.1 billion. But IBM remains confident about its future and expects consistent growth in revenue and free cash flow this year.

Revenue from IBM’s cloud business was up 19% year-over-year and helped offset weakness in other areas. In the Q3 earnings call, IBM CFO James Kavanaugh said that cloud revenue was driven by its partnership with Red Hat and IBM’s full-stack capabilities.

The third quarter results showed that IBM generated $1.5 billion in net cash from operations. Total revenue was $21.5 billion, down 8% from last year’s third quarter, but up 4% from the year-ago quarter. Earnings per share were 94 cents, which beat the analysts’ estimate of $1.13. IBM also returned $1.5 billion in dividends to its shareholders.